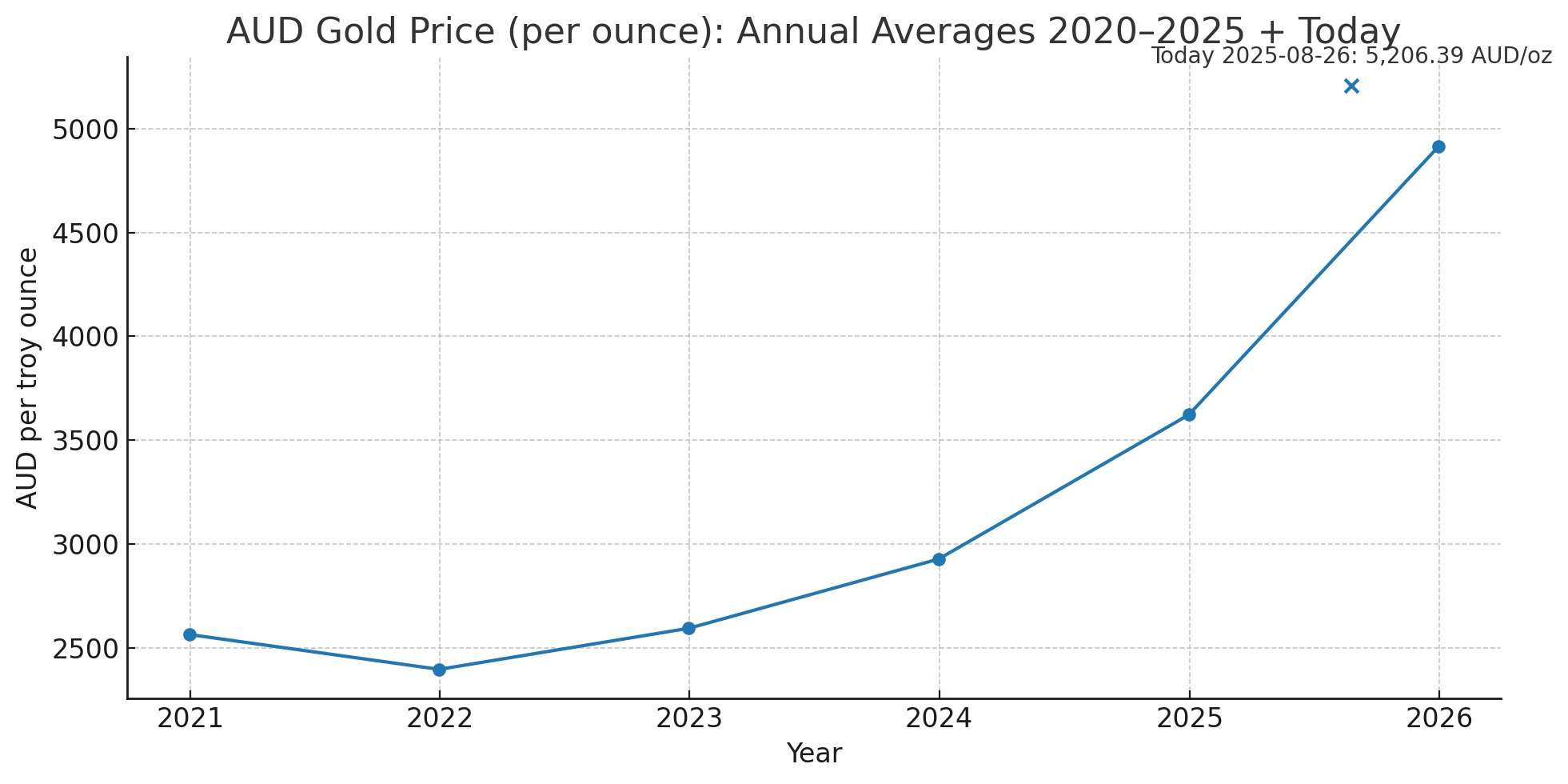

Gold has been on a remarkable run in Australian dollar terms, climbing from pandemic levels in 2020 to today’s all-time highs. For Australians holding gold, the past five years have proven just how powerful this precious metal can be as a safe-haven and long-term investment.

A Five-Year Journey in AUD Gold

- 2020 – Gold averaged AUD 2,564/oz, spiking as COVID-19 rocked global markets.

- 2021 – Prices eased to AUD 2,397/oz as recovery gained traction.

- 2022 – Inflation and the war in Ukraine lifted gold to AUD 2,595/oz.

- 2023 – Momentum built further, averaging AUD 2,928/oz.

- 2024 – Record highs were set, with gold averaging AUD 3,622/oz.

- 2025 (so far) – Gold has exploded to a year-to-date average of AUD 4,913/oz, with today’s physical price hitting AUD 5,206/oz (26 August 2025).

Why Gold Keeps Rising

- Global uncertainty – Geopolitical risks and wars have strengthened demand.

- Central bank buying – Countries continue to add gold to reserves.

- Weakening AUD – Currency shifts amplify gains for local investors.

- Safe-haven appeal – In volatile markets, gold remains a trusted store of wealth.

What It Means for You

With gold more than doubling since 2020, now is a prime moment to review your holdings. If you’re thinking of selling, today’s record gold prices mean you can unlock more value than ever before. And if you’re holding, the long-term fundamentals remain strong.

At GoldCompany, we pay the highest prices in Sydney for gold jewellery, bullion, and scrap gold – with same-day cash payments.

Comments are closed